The Inland Revenue Authority of Singapore (IRAS) and the Infocomm Media Development Authority (IMDA) have introduced a major change to business invoicing requirements. The phased adoption of InvoiceNow for GST-registered businesses will begin in November 2025, starting with newly incorporated businesses that voluntarily register for GST. To be clear, this marks a substantial change in financial transaction management for Singapore companies.

Cloud-based accounting solutions are essential tools for this e-invoicing transition. We have extensively evaluated and implemented various cloud accounting solutions for clients across different sectors, which led us to adopt Xero as our preferred platform. This decision makes Xero an ideal example for demonstrating how online accounting tools can create direct, practical paths to e-invoicing implementation while simplifying accounting operations.

This analysis will show the significant benefits that integrating cloud accounting with the InvoiceNow network will bring to Singapore’s small and medium-sized enterprises (SMEs). By improving efficiency and meeting upcoming regulatory requirements, this transition promises a more streamlined and cost-effective future for Singapore’s SMEs.

Understanding InvoiceNow and Xero Integration

InvoiceNow operates on the Peppol network, a secure global public infrastructure for standardised electronic document exchange. Over 60,000 businesses in Singapore already use the InvoiceNow network, which streamlines invoice processing and accelerates payment cycles while reducing paper usage.

Network Security and Infrastructure

InvoiceNow, utilising the Peppol network, operates with cutting-edge security measures, including:

- PKI certificate authentication for all Access Points

- SSL transport layer security for data transmission

- Digital signing of all transmitted data

- Verification of Access Point signatures for receiving systems

Xero’s InvoiceNow Integration and Features

Xero’s integration with InvoiceNow brings several automatic functions to Singapore SMEs:

Direct Bill Reception

- E-invoices arrive as draft bills in Xero

- No manual data entry required

- Automatic population of supplier details

- Real-time invoice updates

Sending E-invoices

- Direct transmission to other registered businesses

- Immediate delivery to government agencies

- Built-in verification of recipient Peppol IDs

- Status tracking of sent invoices

Registration and Setup

- Free registration via Xero platform

- CorpPass authentication integration

- Automatic Peppol ID assignment

- Public directory listing for easy discovery

Business Impact and System Value

Tax Compliance Benefits

- InvoiceNow e-invoices are accepted by IRAS as valid tax invoices for GST purposes

- No requirement for “Tax Invoice” wording on e-invoices

- Meets all GST documentation requirements when including standard invoice elements

- Simplified GST reporting and compliance processes

Operational Improvements

Data Accuracy

Manual data entry introduces significant risks to business operations. Research indicates a 3.7% error rate in manual entries – translating to 370 potential mistakes per 10,000 entries. InvoiceNow through Xero addresses this issue by providing:

- Reduced input errors

- Standardised format across all invoices

- Automatic validation checks

- Consistent record-keeping

Payment Efficiency

The IMDA InvoiceNow FAQs show some striking improvements in payment timing:

- 92% of e-invoices paid on time versus 45% of paper invoices

- Faster processing cycles

- Improved cash flow management

- Automated reconciliation

Environmental Benefits

Digital invoicing reduces:

- Paper consumption

- Storage space needs

- Printing costs

- Physical filing systems

Financial Benefits

The financial benefits of e-invoicing adoption present a clear business case. IMDA research indicates businesses save approximately $8 per invoice processed via InvoiceNow. For companies processing hundreds of invoices monthly, these savings add up significantly.

Cost Savings

- $8 average savings per invoice processed

- Senders reduce costs by 59%

- Recipients reduce costs by 64%

- Minimised storage and manual processing expenses

Technology Investment

- Xero customers require no additional software beyond Xero subscription

Productivity Gains

- Staff reallocation to higher-value tasks

- Automated data capture

- Faster month-end closing

- Simplified audit preparations

Additional Cost Considerations

- While Xero’s InvoiceNow implementation is free of charge, some accounting software providers may charge based on invoice volume

- Some other providers may also apply fees for add-on services, e.g. PDF-to-Peppol conversion services

- It is therefore important to evaluate total cost implications when selecting service providers

Our accounting teams observe that businesses in Singapore (that already utilise e-invoicing) report significant improvements in their financial operations. Small businesses benefit from automated processes previously available only to larger corporations, while larger organisations gain better oversight of their invoice workflows.

Even if some costs are involved, InCorp agrees with the IMDA’s assessment that the overall savings of moving to e-invoicing should exceed any costs.

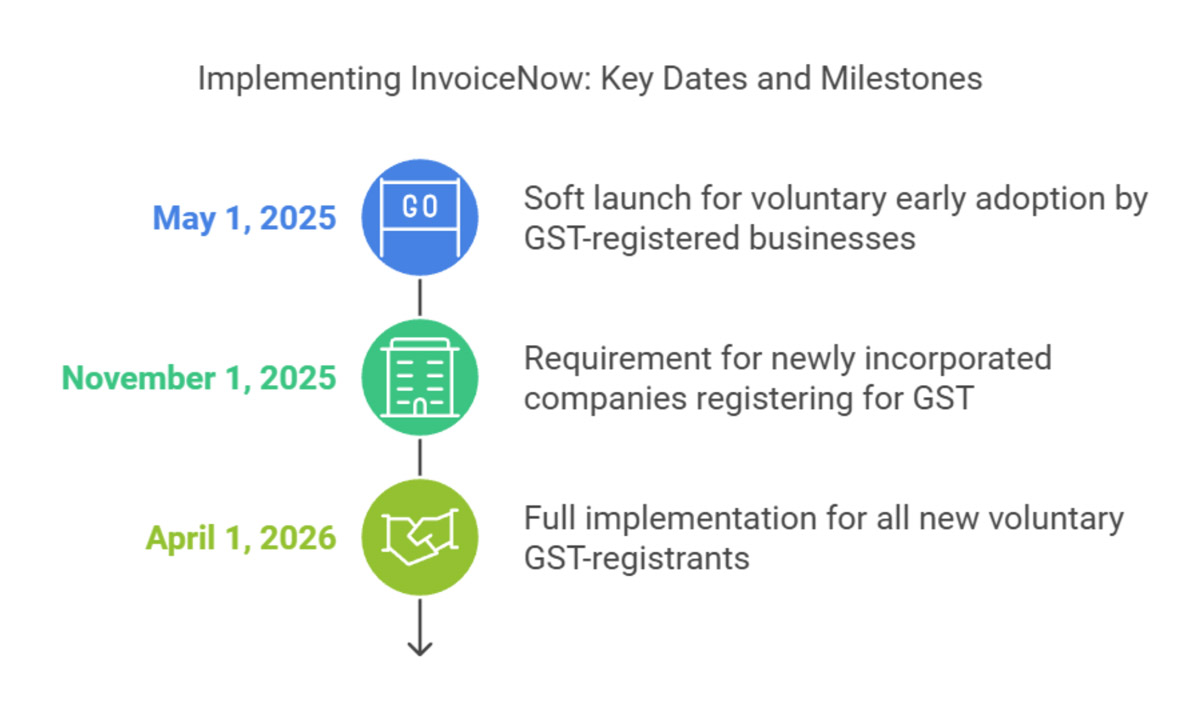

InvoiceNow Implementation Timeline

IRAS and IMDA have outlined a clear timeline for InvoiceNow adoption. Business leaders should note these key dates:

Phase One: 1 May 2025

- Voluntary early adoption period begins

- Available for GST-registered businesses

- Soft launch phase

Setting Up InvoiceNow With Xero: Practical Steps for Businesses

Setting up Xero for e-invoicing follows a straightforward process that streamlines adoption for SMEs.

Initial Setup

- System Requirements:

- Active Xero subscription

- Singapore-based business with Unique Entity Number (UEN)

- CorpPass access

- Internet connection

- Registration Steps:

- Connect your Xero organisation to a Xero-integrated app

- Authorise with CorpPass (requires QR code scan with Singpass app)

- Receive your unique Peppol ID

- Get your unique Xero InvoiceNow email address

Setting Up Your Network

- Find Your Trading Partners:

- Search the SG Peppol Directory for registered businesses

- Share your Peppol ID with suppliers

- Collect Peppol IDs from customers

- Add customer Peppol IDs to their contact details in Xero for easy reference

- Important Notes:

- One Xero organisation can only handle one UEN

- All businesses on the network can exchange invoices regardless of their accounting software

- The system supports both e-invoices and electronic purchase orders (ePO)

Sending E-invoices

- Create Your Invoice:

- Prepare invoice as usual in Xero

- Select “Approve & email” when ready to send

- Apply any available credits if needed

- Delivery Process:

- Enter recipient’s unique Xero InvoiceNow email address

- Add multiple recipients using commas or semicolons

- Complete remaining email fields

- Click “Send”

- Track Your Invoice:

- Check sent status in Xero

- View confirmation message

- Track unique transmission ID in history

Receiving E-invoices

- Monitor Incoming Documents:

- Check regularly for new draft bills in Xero

- Review automatically populated data

- Electronic purchase orders appear as draft invoices

- Process Received Documents:

- Verify invoice details

- Approve for payment

- Process payments within Xero

Best Practices

- Regular Maintenance:

- Check draft bills frequently

- Keep contact Peppol IDs updated

- Monitor invoice statuses

- Staff Training:

- Ensure team familiarity with the system

- Establish standard operating procedures

- Maintain documentation of processes

The system maintains parallel capabilities for traditional invoicing methods, as not all companies will be set up for sending/receiving e-invoicing. Businesses will continue to receive invoices through other channels while maximising the benefits of electronic processing where available.

Future Implications and Strategic Benefits

Data Privacy and Security

- Government agencies cannot access or track e-invoice contents under current regulations

- Direct peer-to-peer routing between sender and receiver Access Points

- Secure transaction environment maintaining business privacy

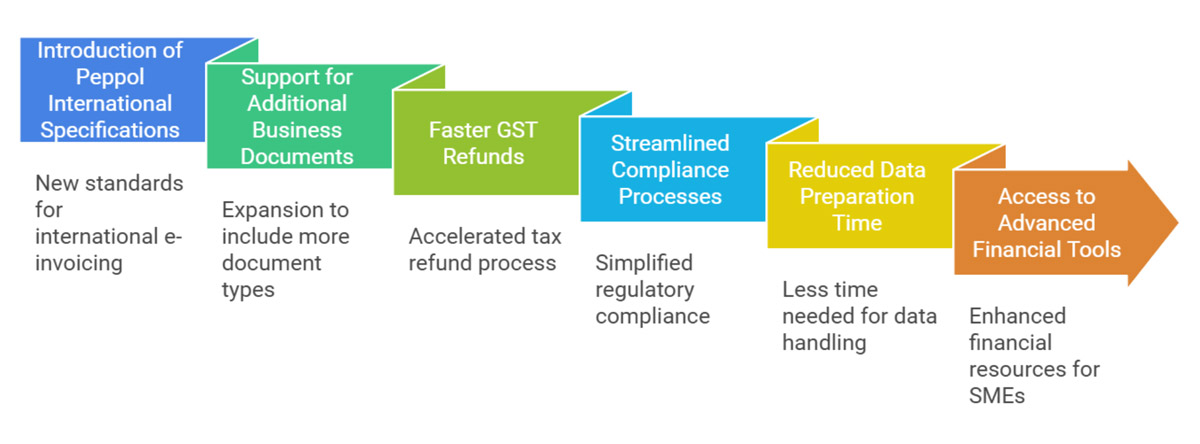

International Capabilities

Cross-border transactions receive particular support through recent InvoiceNow enhancements. The introduction of Peppol International (PINT) specifications allows businesses to send e-invoices without adapting them to match receiver-specific domestic requirements. This creates substantial benefits for companies engaged in international trade.

Beyond standard e-invoices, the network now supports additional business documents, including electronic Purchase Orders and Invoice Responses. This broadens the digital capabilities of the procure-to-pay process.

The adoption of e-invoicing positions businesses for faster GST refunds and streamlined compliance processes. Companies can reduce data preparation time for IRAS submissions while maintaining more accurate records. Perhaps most beneficial of all, Singapore SMEs gain access to sophisticated financial tools that improve their competitive position in both local and international markets.

Where to Next With InCorp

The adoption of e-invoicing marks a significant and compelling step in Singapore’s digital transformation of business processes. As IRAS and IMDA roll out mandatory requirements from 2025, our tax experts see particular merit in cloud accounting platforms such as Xero that include e-invoicing capabilities at no additional cost.

The built-in InvoiceNow functions in platforms like Xero are especially noteworthy in their ability for Singapore SMEs to reduce barriers to adoption while delivering improved payment cycles and accuracy.

In our opinion, companies that select integrated solutions position themselves to benefit from both immediate efficiency gains and future innovations in digital financial workflows. This approach creates practical advantages for SMEs competing in an increasingly digital economy.

If you would like more information on how your business can take advantage of e-invoicing or cloud accounting platforms like Xero, contact InCorp today.

About Xero

Xero is a global small business platform with 4.2 million subscribers. Xero’s smart tools help small businesses and their advisors to manage core accounting functions like tax and bank reconciliation, and complete other important small business tasks like payroll and payments. Xero’s extensive ecosystem of connected apps and connections to banks and other financial institutions provide a range of solutions from within Xero’s open platform to help small businesses run their business and manage their finances more efficiently.

FAQs about Xero Support E-invoicing in Singapore

How much does InvoiceNow cost with Xero in Singapore?

- InvoiceNow functionality comes included in all Xero subscription plans (Starter, Standard, and Premium) at no additional cost. Registration for InvoiceNow through Xero is free, and no external software or services are required.

When will InvoiceNow become mandatory in Singapore?

- IRAS and IMDA will implement mandatory InvoiceNow requirements starting November 2025 for newly incorporated companies that register for GST voluntarily. By April 2026, all new voluntary GST registrants must participate in the programme.

What are the benefits of using Xero for e-invoicing in Singapore?

- Xero's e-invoicing integration offers automatic draft bill creation, direct invoice transmission, reduced data entry errors, faster payment cycles, and simplified GST compliance. Research shows e-invoicing can save businesses approximately S$8 per invoice processed.