The Inland Revenue Authority of Singapore (IRAS) functions as Singapore’s primary tax body, combining tax collection duties with expert government advisory services. IRAS’s policies and procedures directly affect financial outcomes and strategic planning for companies and individuals conducting business in Singapore.

As a division of the Ministry of Finance, IRAS oversees approximately 70% of the Singapore Government’s Operating Revenue through its tax programmes. These funds power Singapore’s world-famous economic growth initiatives and social development projects, placing IRAS at the foundation of the country’s progress.

Singapore’s tax approach offers clear benefits for international businesses. Companies pay taxes based on their profit sources rather than their registration location, which creates practical advantages for organisations choosing Singapore as their operational base.

This article breaks down IRAS’s core responsibilities, tax collection systems, and digital tools to help business leaders work productively with Singapore’s tax authority.

History of IRAS Singapore

IRAS’s roots trace back to 1947 when Singapore created its Income Tax Department. The department processed 40,000 individual and 1,000 corporate tax returns in its first assessment year, collecting $33.2 million between January 1948 and December 1949.

The tax structure saw its first significant shift in 1960, with the formation of the Inland Revenue Department (IRD) following Singapore’s self-governance in 1959. This change brought various revenue streams under one administration, streamlining tax collection processes.

Singapore’s independence in 1965 prompted substantial changes to the Income Tax Act, effective January 1966. By 1970, the department oversaw twelve Acts and appointed its first local Commissioner, Mr Hsu Tse-Kwang.

The 1970s brought operational improvements:

- Enhanced staff training programmes

- Microfilming introduction for space efficiency

- Computer systems for property tax administration

Challenges emerged as Singapore grew:

- Staff shortages

- Tax assessment backlogs

- Collection delays

- Private sector competition for skilled staff

The solution came on 1 September 1992 with IRAS’s establishment as a statutory board under the Ministry of Finance. This restructuring provided:

- Administrative autonomy

- Financial resource control

- Personnel management flexibility

This transformation positioned IRAS to deliver improved tax administration services to Singapore and its residents.

Core Functions and Authority of IRAS

IRAS performs two distinct but interconnected roles in Singapore’s financial structure – tax collection and tax advisory to the Singapore Government.

1. Collection Role

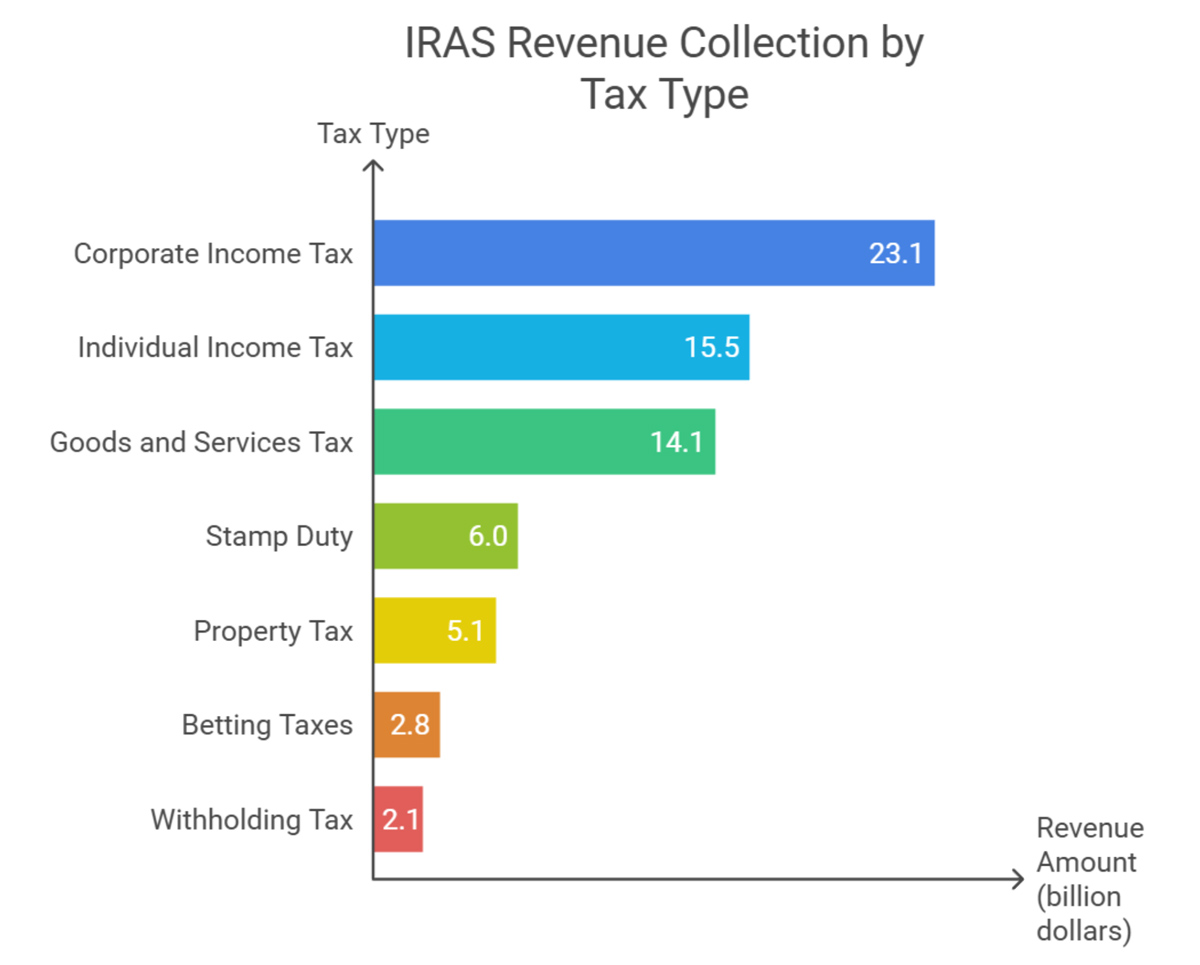

As the nation’s primary tax collector, IRAS administers an array of tax categories that fund government programmes and public services. These funds directly support Singapore’s economic growth and social development projects.

Tax Categories IRAS oversees these specific tax types:

- Stamp Duty for Shares

- Withholding Tax

- Income tax for individuals and companies

- Property Tax

- Goods and Services Tax (GST)

- Trust tax

- Estate Duty

- Stamp Duty for Property

- Stamp Duty for Property-Holding Entities

- Clubs and Associations tax

- Private Lotteries Duty

- Casino Tax

- Betting and Sweepstake Duties

- Charities tax

Data source: IRAS.

Tax Exclusions

A key distinguishing feature of Singapore’s system lies in what IRAS does not tax. The authority excludes dividends, capital gains and inheritance from taxation, creating an appealing environment for business investment and wealth management.

Territorial Taxation

Through its territorial taxation approach, IRAS focuses on profit origins rather than company registration locations. For example, if a Singapore-registered company generates profits from British operations through a British bank account, IRAS only taxes the portion that reaches Singapore for company expenses.

This practical application of territorial taxation shows how IRAS supports international business operations while maintaining clear oversight of Singapore-sourced income.

2. Advisory Function

In its advisory capacity, IRAS holds significant influence over Singapore’s tax framework. The organisation drafts tax policies, supports the Ministry of Finance in creating tax legislation, and structures international tax agreements.

These agreements prove particularly valuable for businesses, as Singapore maintains over 100 double taxation treaties (DTAs) with other countries. Such arrangements prevent companies from paying tax twice on the same income across different jurisdictions.

IRAS Filing Calendar 2025

| IRAS Filing Calendar 2025 | |

|---|---|

| 31 January |

|

| 1 March |

|

| 31 March |

|

| 15 April |

|

| 18 April |

|

| 31 May |

|

| 30 June |

|

| 30 September |

|

| 31 October |

|

| 30 November |

|

| 31 December |

|

Please note these dates are accurate at the time of writing and may be subject to change at IRAS’s discretion.

IRAS Digital Integration and Compliance

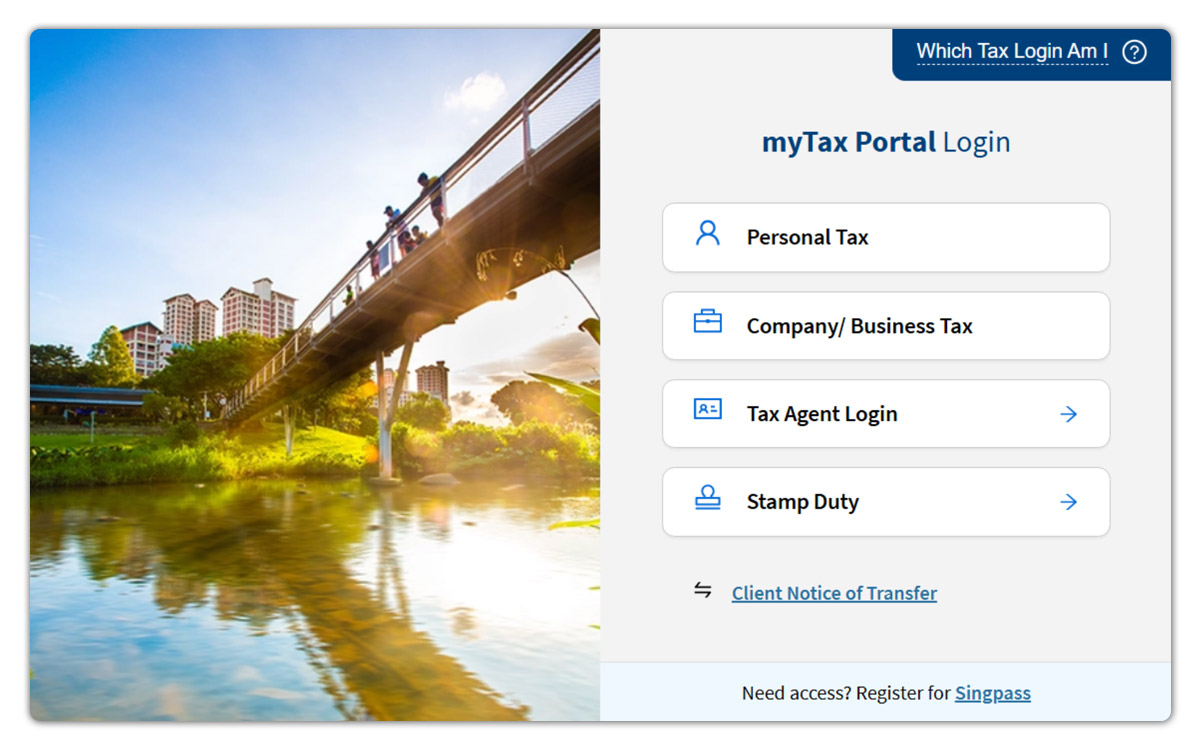

IRAS provides digital access to tax services through myTax Portal, its main online platform. Access methods differ between businesses and individuals:

IRAS provides digital access to tax services through myTax Portal, its main online platform. Access methods differ between businesses and individuals:

Business Access

Companies use CorpPass ID to sign in to myTax Portal. This digital identification system lets businesses check their tax status and handle tax matters online.

Related Read: CorpPass: How to Register and Manage Your Business Access

Individual Access

For personal tax matters, individuals access myTax Portal using their SingPass ID.

Software Integration IRAS allows connection between accounting software and its systems, subject to specific criteria:

- Software must meet IRAS technical requirements

- Programmes must appear on IRAS’s approved software list

Online Support

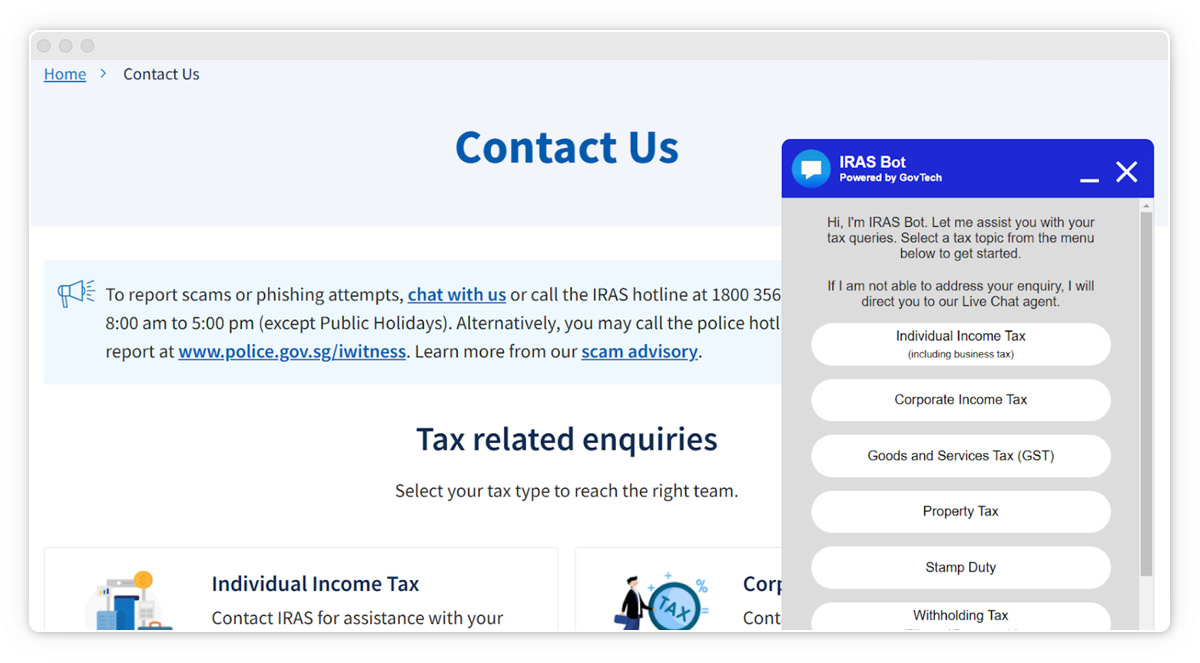

IRAS offers digital assistance through its Virtual Assistant “IRAS Bot”. This automated helper appears in the corner of the IRAS website to support taxpayers with their queries.

Best Practices for IRAS Compliance

IRAS’s strict standards and systematic processes support Singapore’s status as a global business hub. These practices align with international standards, building trust among investors and business partners worldwide.

Filing Standards

- Submit documents before deadlines to avoid penalties

- Keep clear records of all business transactions

- Store tax documents in organised filing systems

- Match bank records with declared income

- Update business information promptly

Related Read: Guide to Filing Corporate Taxes – Form C-S and Form C

Digital Integration

- Use myTax Portal for all online transactions

- Set CorpPass access for authorised staff only

- Back up digital tax records regularly

- Choose IRAS-approved software solutions

Professional Support

A trusted corporate services provider creates significant advantages for businesses managing IRAS obligations. Professional tax advisors offer:

- Proactive tax planning and risk assessment

- Expert handling of complex tax matters

- Direct liaison with IRAS

- Up-to-date knowledge of tax regulations

- Systematic compliance monitoring

- Precise documentation preparation

Working with established providers like InCorp brings additional benefits:

- Dedicated tax specialists with deep IRAS experience

- Proven track record of successful filings

- Comprehensive compliance systems

- Real-time tax updates and guidance

- Multi-jurisdictional tax expertise

- Internal quality control processes

Internal Best Practices

- Train staff on tax compliance procedures

- Review tax positions regularly

- Set internal deadlines ahead of IRAS deadlines

- Create clear roles for tax-related responsibilities

While large organisations often maintain internal tax teams, businesses of all sizes benefit from partnering with established corporate service providers.

A trusted advisor like InCorp brings proven on-the-ground IRAS experience, proven compliance systems, and deep local knowledge that complements internal resources. This partnership approach gives business leaders confidence in their tax compliance while letting them focus on core business growth.

Where to Next With InCorp

While this article provides an overview of IRAS’s functions and systems, businesses can achieve much more through strategic tax planning. Singapore offers multiple tax reduction opportunities, incentives, and benefits through its extensive network of DTAs.

For businesses ready to optimise their tax position and maximise these advantages, InCorp’s tax specialists provide expert guidance tailored to your specific needs. Contact our team to explore how your business can benefit from Singapore’s tax frameworks.

FAQs about IRAS Singapore

What is the minimum salary to pay income tax in Singapore?

- In Singapore, the threshold for paying income tax is currently set at an annual income of $22,000 or more.

Where can I find a Singapore income tax calculator?

- You can find it on our website here!

How can I get help with managing IRAS’ tax guidelines?

- You can contact our friendly team to find out how we can help!