Cloud-based accounting solutions have swiftly yet unsurprisingly reshaped financial management practices worldwide, with the sector project to expand to US$10.1 billion by 2033, with a 6.6% compound annual growth rate. This growth reflects businesses seeking better data security, real-time financial insights, and integrated operations.

All Southeast Asian small and medium enterprises are seeking these advantages, with leading platform Xero reporting 11% year-on-year subscriber growth as of 31st Mar 2024, led by the Asia-Pacific region. This mirrors what we see at InCorp, where businesses, from startups to 200-person companies, benefit from cloud accounting platforms like Xero.

Our analysis and implementation of various solutions led us to standardise Xero for our clients – making it an ideal case study for exploring how online accounting tools serve growing businesses.

This article examines the key benefits Singapore companies gain from cloud accounting platforms. Drawing from our experience supporting diverse businesses across Asia, we will use practical examples from Xero cloud accounting software to illustrate how these tools strengthen financial operations and support business growth.

Real-Time Financial Visibility

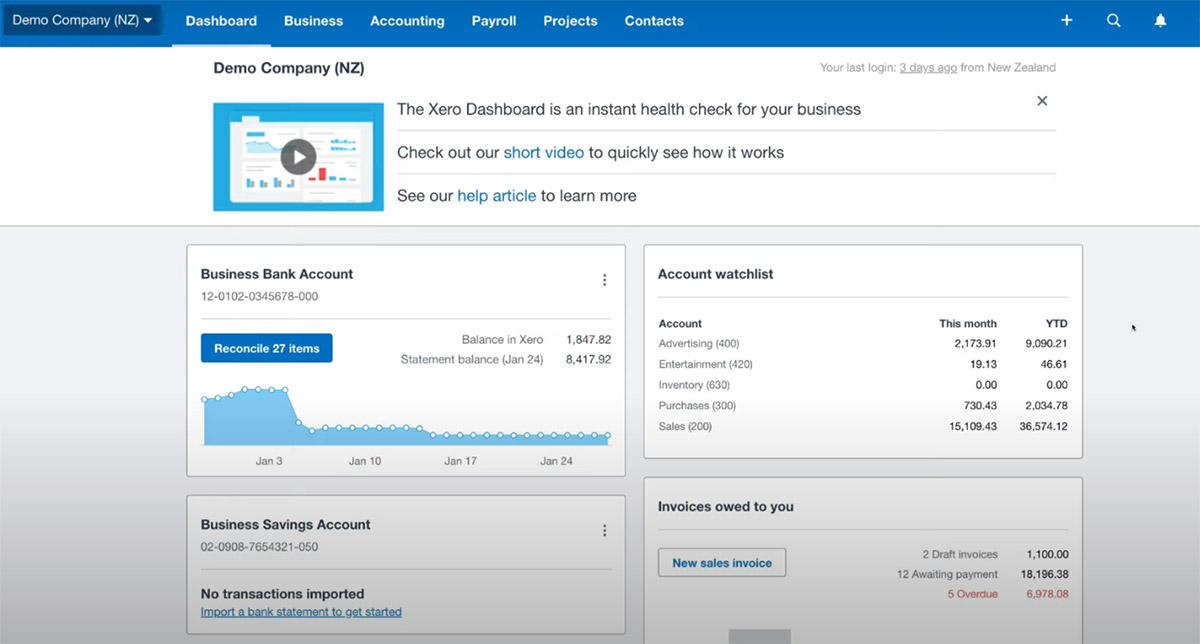

Financial decision-making depends on accurate, current data. Cloud accounting platforms like Xero have undeniably redefined how businesses monitor their financial health through automated bank feeds, intuitive dashboards, and integrated reporting tools.

Bank Connection and Cash Flow Management

The bank securely feeds sync transactions into the accounting system each business day. This automation eliminates manual data entry and provides an up-to-date cash flow picture. The system matches transactions automatically, making reconciliation simpler and faster.

Business Performance Monitoring

Xero’s dashboard immediately shows key, customisable financial information at login, allowing you to see all of your business’s critical data at a glance, such as:

- Bank balances

- Who owes you money

- Bills you need to pay

Beyond the dashboard, you then have more options to delve deeper, not limited to:

- Business Tab

- Short-term cash flow

- Business snapshot

- Invoices

- Sales Overview

- Bills to pay

- Purchase orders

- Purchase overview

- Expense claims

- Products and services

- Accounting Tab

- Bank accounts

- Reports

- Account transactions

- Aged payables summary

- Aged receivable summary

- Balance sheet

- GST return

- Profit and loss

- Advanced

- Chart of accounts

- Find and recode

- Fixed assets

- Manual journals

- Projects Tab

- All projects

- Time entries

- Staff time overview

- Staff cost rates

- Contacts Tab

- All contacts

- Customers

- Suppliers

As you can see, there are a plethora of tools available, allowing you to keep things as simple or as granular as you like. One of our clients, a health and fertility centre in Singapore, used these tools to track profitability by service line.

The real-time data helped them optimise their service mix and improve margins dramatically, showing the power of having this vital data at your fingertips. Another client, a restaurant group, monitored performance across four locations simultaneously, supporting their expansion from one to multiple outlets – all from the information Xero gave them.

Streamlined Compliance and Reporting

Singapore businesses face specific reporting obligations, including GST returns and corporate tax filings. Cloud accounting platforms like Xero address these requirements through direct integration with government systems.

GST Filing Integration

The Inland Revenue Authority of Singapore (IRAS) accepts direct GST submissions through approved platforms such as Xero. This enables businesses to:

- Submit GST returns monthly or quarterly

- File directly from accounting data

- Meet compliance deadlines efficiently

Tax Data Management

In 2025, a significant change arrives as IRAS and the Infocomm Media Development Authority (IMDA) introduce new e-invoicing tax data submission requirements through the InvoiceNow network. Xero can help businesses prepare for this shift by streamlining compliance and ensuring compatibility with the InvoiceNow platform.

- Invoice-ready solutions meeting IRAS and IMDA standards

- Direct data transmission capabilities

- Automated compliance tracking

Data Security

Financial data protection remains crucial for businesses. Professional cloud platforms employ:

- Advanced encryption methods

- Multi-factor authentication

- Bank-grade security protocols

- ISO 27001 certification for data handling

These measures give businesses confidence their financial information stays protected while remaining accessible to authorised users.

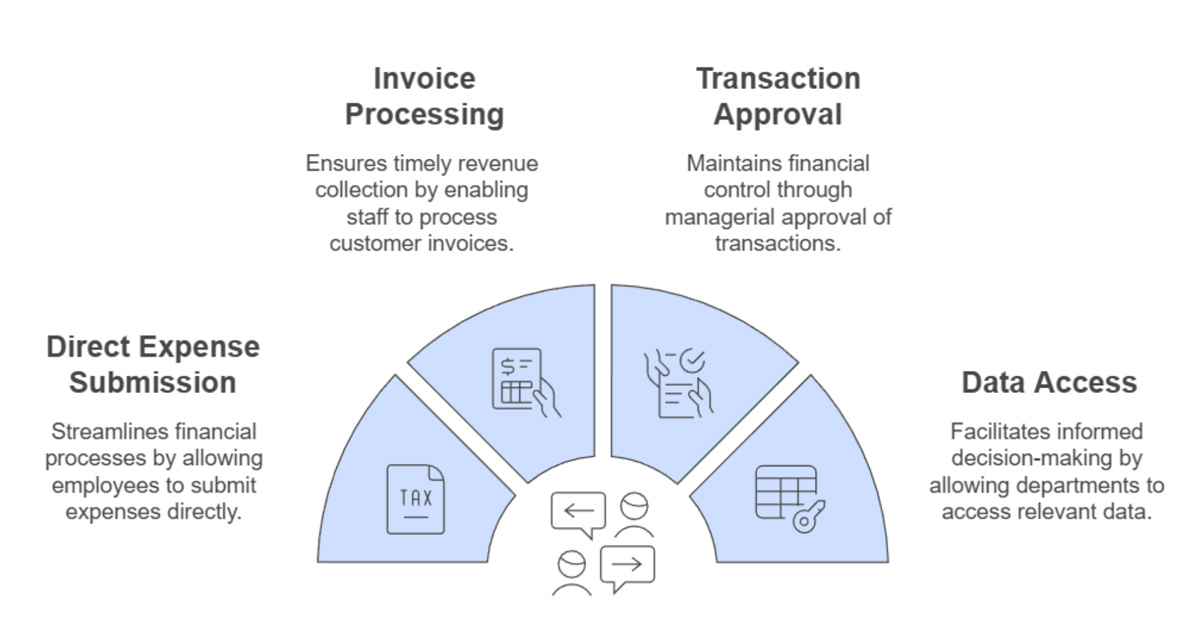

Collaboration and Accessibility

Business success often depends on effective teamwork between owners, employees, advisors, and financial professionals. Leading cloud platforms like Xero support this collaboration while maintaining proper controls.

Multi-User Benefits

Teams can collaborate using e-invoicing thanks to:

Real-Time Professional Input

Business owners and their advisors gain advantages through shared access:

- View the same financial data simultaneously

- Discuss business performance in real-time

- Leave comments on specific transactions

- Address questions promptly

Mobile Access

The Xero mobile app connects business owners to their financial data from any location. Users can:

- Check bank balances

- Process outstanding invoices

- Convert quotes to invoices

- Monitor business performance

- Review bills needing payment

This accessibility helps business owners stay informed and make timely decisions, whether at client meetings, between appointments or working remotely.

Integration and Automation

Xero reduces manual tasks through automation and connection to other business tools. This creates better efficiency, all while improving data accuracy.

Connected Business Apps

The Xero software platform connects with essential business tools:

- Payment systems like Stripe

- Point-of-sale solutions

- E-commerce platforms including Shopify

- Inventory management systems

- Professional apps for specific industries

Referring back to our health and fertility client in Singapore, we can see how this integration works. Connecting their practice management system with their accounting platform allowed them to streamline processes and gain better financial oversight.

Automated Data Processing

Automation simplifies routine tasks:

- Bank transactions flow directly into accounts

- Invoices are generated from quotes with one click

- Expenses capture through mobile photos

- Payments match invoices automatically

App Selection Advantages

Businesses choose apps based on their needs:

- Retail operations add POS systems

- Online sellers connect e-commerce platforms

- Service firms integrate time-tracking

- Product companies link inventory management

Business Growth Support

Leading cloud accounting platforms like Xero adapt as businesses expand. This scalability proves valuable for companies at different growth stages.

Growth Monitoring

Financial data provides clear growth indicators:

- Sales trends over time

- Profit margin analysis

- Cash flow patterns

- Business unit performance

Business Planning Support

Xero provides clear financial data that aids Singapore businesses in structured growth.

- Track performance against targets

- Identify successful business areas

- Spot improvement opportunities

- Make evidence-based decisions

System Adaptability

Xero grows with businesses through:

- Adding new users as teams expand

- Connecting additional bank accounts

- Integrating more business apps

- Scaling transaction volumes

These insights help businesses respond to changes and opportunities with confidence. Small companies particularly benefit from professional-grade financial tools that were only available only to larger firms previously.

As an added benefit, Xero becomes more valuable as businesses grow, eliminating the need to switch systems or retrain staff during expansion phases. This allows companies to focus on growth rather than cumbersome system changes.

Implementation and Support

Adopting a new accounting system, even one as user-friendly as Xero, requires planning. Looking at InCorp’s experience with Xero implementations, successful transitions share common elements.

Migration Process

Moving from existing systems involves:

- Preserving historical financial data

- Setting up direct bank feeds

- Configuring user access

- Connecting business apps

InCorp specialises in migrating businesses from various accounting platforms, ensuring past data remains accessible while setting up new processes. The process supports different business types, from retail operations needing point-of-sale integration to e-commerce companies requiring online payment connections.

Professional Support

InCorp can help businesses leverage Xero for maximum performance in the following ways:

- Review financial data periodically

- Identify cash flow patterns

- Monitor payment cycles

- Make informed business decisions

We encourage all of our businesses using Xero to sit down with us periodically to make sure they are making the most of the platform. Small and medium enterprises benefit from this combination of modern accounting tools and professional guidance, resulting in more time focused on business growth, and less on administrative tasks.

Where to Next With InCorp

Business growth in Singapore relies on accurate financial data and efficient processes. Cloud accounting platforms like Xero provide these advantages with professional support through firms like InCorp.

Our experience implementing these systems shows clear benefits: better financial visibility, streamlined compliance, and stronger growth support. Contact our team to explore how cloud accounting can strengthen your business operations in Singapore and the Asia Pacific.

About Xero

Xero is a global small business platform with 4.2 million subscribers. Xero’s smart tools help small businesses and their advisors to manage core accounting functions like tax and bank reconciliation, and complete other important small business tasks like payroll and payments. Xero’s extensive ecosystem of connected apps and connections to banks and other financial institutions provide a range of solutions from within Xero’s open platform to help small businesses run their business and manage their finances more efficiently.

FAQs about The Benefits of Using Xero

Can Xero handle GST submissions in Singapore?

- Yes, Xero integrates directly with IRAS for GST submissions. The platform enables automated monthly or quarterly GST returns filing directly from your accounting data.

What security measures does Xero use to protect financial data?

- Xero employs bank-grade security protocols, including advanced encryption and multi-factor authentication. The platform maintains ISO 27001 certification for data handling standards.

Can small businesses use Xero for accounting in Singapore?

- Yes, businesses from startups to established SMEs use Xero. The platform scales with your business, offering features like invoicing, bank reconciliation, and financial reporting.